Simply: APR is how much it costs to borrow money. But what does that mean? And why does that matter?

Some people think interest rates and annual percentage rates are the same thing. While that’s typically true for credit cards, the terms have different meanings when it comes to loans. It’s important to realize that they’re different, checking both the interest rate and the APR when you’re considering taking out a loan.

An interest rate is the percentage of the principal that a lender charges you to borrow the money. So what is APR? Instead of just including the interest rate, APR can also include fees you may be required to pay to take out the loan. So APR gives you a better idea of the cost of the loan as a percentage.

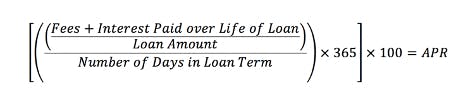

What is the formula for calculating APR?

Calculating APR isn’t as difficult as you might think. Here’s the formula you would use to calculate the APR of a loan with fees. Note: If a loan doesn’t have fees (and this is rare), you can simply replace the fees placeholder in the formula with a zero.

Image: what-is-apr-calculation

Image: what-is-apr-calculationIf that sounds confusing, take a look at how we break it down in the following example.

Let’s say Frank is taking out a $1,000 loan. And over a 180-day loan term, he’ll end up paying $75 in interest. He’ll also pay a $25 origination fee to take out the loan.

Let’s plug those numbers into Frank’s calculator to see how he can calculate his APR.

- First, add the origination fee and total interest paid.

$75 + $25 = $100

- Then, take that number and divide it by the loan amount.

$100 / $1,000 = 0.1

- Next, divide the result by the term of the loan.

0.1 / 180 = 0.00055556

- Then, multiply that result by 365.

0.00055556 x 365 = 0.20277778

- Finally, multiply that by 100 to get the APR.

0.20277778 x 100 = 20.28%

When could you encounter APR?

You’ll likely encounter APRs at many points in your life, mainly when dealing with credit. Many types of credit products, such as car loans and mortgages, might only have one APR you have to pay attention to, but other types of debt may have multiple APRs.

When you receive credit card offers in the mail, they may list several different APRs. For example, you may see a purchase APR listed in the card’s terms and conditions, but you may also see a balance transfer APR, penalty APR or cash advance APR.

Whenever you take out any type of debt, make sure to find out the different types of APRs you could be charged and what triggers each one. Most of the time, it’s pretty straightforward. That said, if you need help, ask the lender to explain when each APR applies.

Why is APR important?

It’s super important that you’re aware of the APR you’re paying on any debt you take out, because it’s the price you pay to borrow the money.

In general, you may want to stay away from debt with high APRs, as the interest payments could end up overwhelming your budget. But even if you manage to find debt with low APRs, taking out too much debt could cause headaches.

Types of APR

It’s also important to know the type of APR on your loan. In most cases, you’ll either have a fixed APR or a variable APR.

A fixed APR means the APR doesn’t change based on an index during the life of the loan. Because of this, fixed APRs can be more predictable when it comes to budgeting.

Variable APRs can change and are tied to an index interest rate, such as the prime rate. So if the prime rate increases, so would a variable APR.

Variable APRs can fluctuate either in your favor or against it. So while a variable APR could potentially provide lower interest rates up front, it can also increase as the associated index increases, which is a downside of variable APRs.

What impacts your interest rate?

Technically, the lender determines what interest rate to offer you when you apply for a loan, which will affect your APR. But there are a number of factors that can play a big part in determining your interest rate, too.

Lenders are likely to consider your credit scores, along with other factors, when offering you an interest rate. Someone with excellent credit scores is likely to get a lower interest rate than someone with lower credit scores for the same loan, assuming all other conditions are the same.

By shopping around for the best loan deal, you may be able to find a lender who can offer you a lower APR.

For example, while one lender may offer you a variable 15% APR loan, another lender might offer you a variable 12% APR loan, even if you apply on the same day with the same exact information. That’s why it can pay to shop around.

It’s important to note that a good APR may be different depending on the type of credit you’re applying for. For instance, the average APR offered on credit cards is generally higher than the average APR offered on mortgages. So while it doesn’t make sense to compare credit card APRs to mortgage APRs, you should compare APRs within the same loan type.

Bottom line

Having a better idea of what APR is can be especially helpful when you’re making a big purchase or getting a credit card. You can use this information to make more-informed decisions, especially when comparing multiple loan options. It’s important to remember that while a lower interest rate may be appealing, the APR on the loan can give you a better idea of what you’ll pay for the loan overall.